PAN card now to be used by information utilities to verify users’ identity

PAN card has now been included on par with other officially valid documents for the use by information utilities to verify the identity of users.

You have to click on the “link Aadhaar” option on the portal’s homepage to proceed. On the following page, you have to enter details such as full name along with your PAN and Aadhaar numbers.

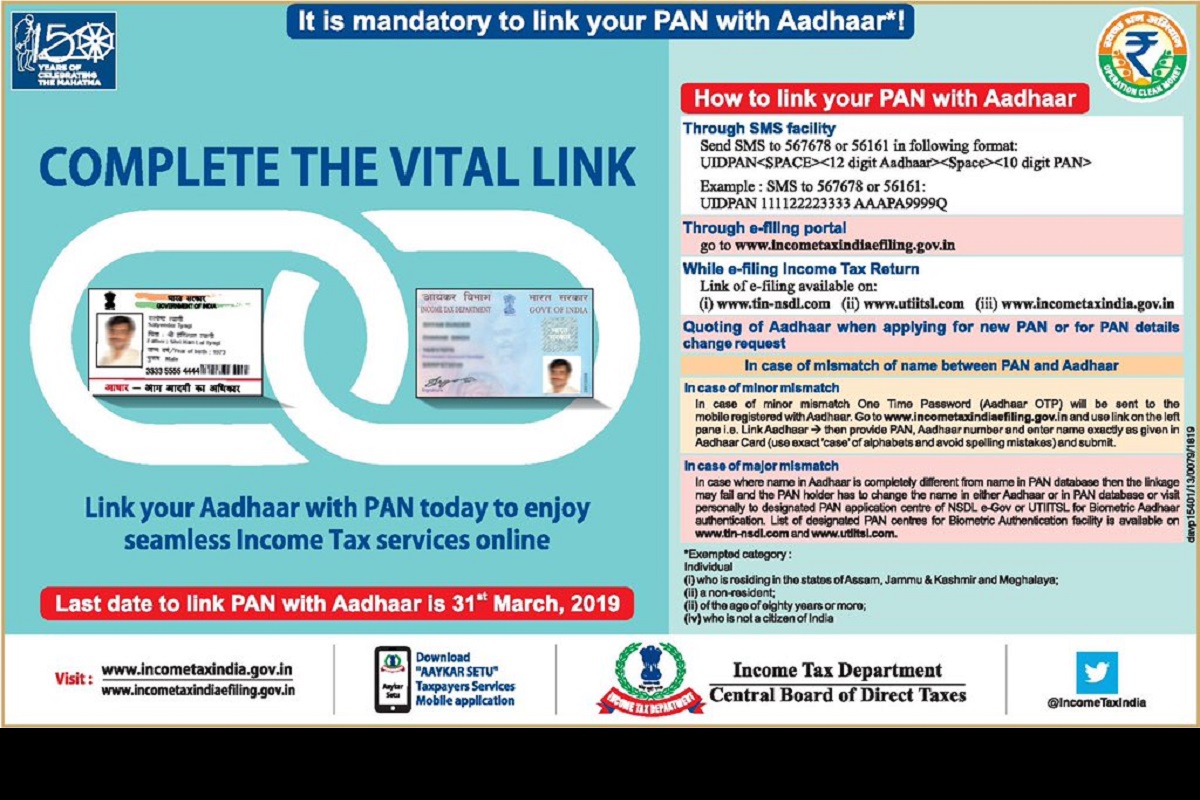

Linking Aadhar and PAN is mandatory and the last date for linking the two is March 31, 2019. (Image: Twitter/@IncomeTaxIndia)

March 31, 2019, is the last date for linking your Aadhar number with your PAN and linking the two has been made compulsory. If the two are not linked, your income tax return would not be processed. The Income Tax department may also cancel all PAN cards that are not linked to Aadhaar. It is also compulsory if you have to carry out a bank transaction above Rs 50,000.

How to link Aadhaar with PAN?

Advertisement

Linking the two is a simple process.

Advertisement

You can link Aadhaar number with PAN online by visiting the Income Tax Department’s e-filing portal incometaxindiaefiling.gov.in

You have to click on the “link Aadhaar” option on the portal’s homepage to proceed. On the following page, you have to enter details such as full name along with your PAN and Aadhaar numbers.

In case only your birth year is mentioned on your Aadhaar card, you have to tick the square. After this, enter the captcha code for verification.

After entering the captcha code, click on the “Link Aadhaar” icon.

A pop-up message will appear indicating that your Aadhaar has been successfully linked with your PAN.

Linking Aadhaar with PAN by sending an SMS

Type a message in this format: UIDPAN <12 Digit Aadhaar> <10 Digit PAN>

Send the message to either 567678 or 56161 from your registered mobile number.

For e.g., if your Aadhaar number is 123412341234 and your PAN is ABCDE1234F, you have to type UIDPAN 123412341234 ABCDE1234F and send the message to either 567678 or 56161.

Once again, linking Aadhar and PAN is mandatory and the last date for linking the two is March 31, 2019.

Advertisement